Latest Version

10.32.2

September 14, 2025

Paytm – One97 Communications Ltd.

35 MB

849

Free

net.one97.paytm

Report a Problem

More About Paytm: Secure UPI Payments

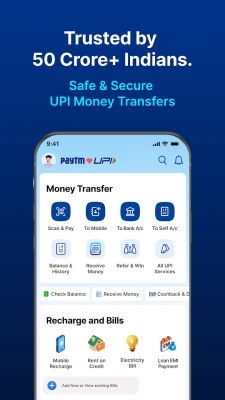

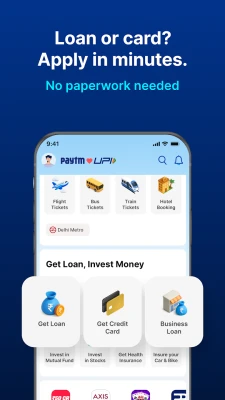

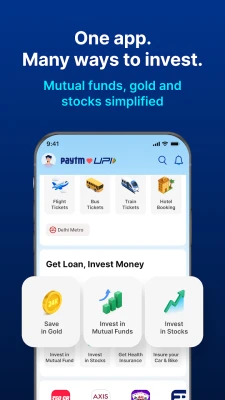

Paytm is one of the most trusted and widely used digital payment platforms in India. From UPI money transfers to mobile recharges and bill payments, Paytm has become an all-in-one solution for managing daily financial needs.

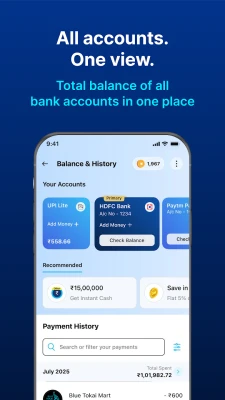

With Paytm, users can link their bank account through UPI and send or receive money instantly, without the need for sharing account numbers or IFSC codes. The process is simple, fast, and secure, making it ideal for everyday use.

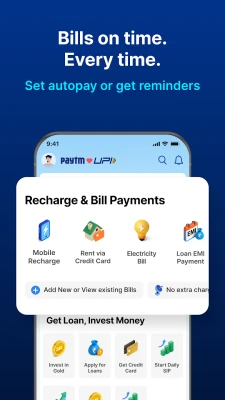

Apart from money transfers, Paytm offers a wide range of services such as mobile and DTH recharges, electricity, gas, and water bill payments, loan repayment, metro recharge, and more. It also allows users to book flight, bus, and train tickets, movie tickets, and event passes directly through the app.

Paytm is also known for its Paytm Wallet, which allows quick payments at shops, restaurants, petrol pumps, and thousands of offline stores. Additionally, the Paytm Postpaid feature enables users to shop now and pay later, adding more convenience to their financial transactions.

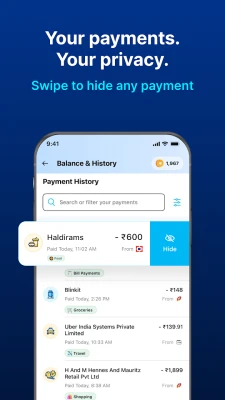

Security is at the heart of Paytm. Every UPI transaction requires PIN verification, and the app uses industry-standard encryption and fraud detection systems to ensure complete safety of your money.

With its reward programs, cashback offers, and merchant acceptance across India, Paytm has become a leading name in digital payments. Whether you’re recharging your phone, paying bills, shopping online, or booking tickets, Paytm makes every transaction simple, secure, and reliable.

Rate the App

User Reviews

Other Apps in This Category

Popular Apps

Editor's Choice