Latest Version

5.1.72

September 14, 2025

PhonePe Pvt. Ltd.

40 MB

6,852

Free

com.phonepe.app

Report a Problem

More About PhonePe UPI, Payment, Recharge

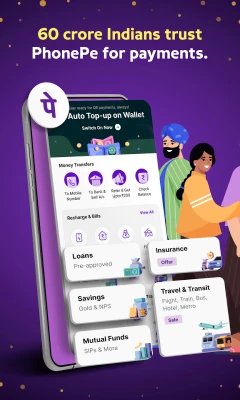

PhonePe has become a household name in India when it comes to digital payments. Built on the UPI (Unified Payments Interface) system, the app allows users to send and receive money instantly, directly from their bank accounts, without the need to carry cash or cards.

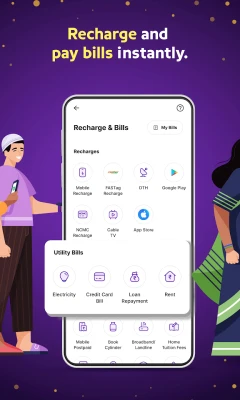

With PhonePe, you can not only transfer money to friends and family but also recharge mobiles, pay utility bills, book LPG cylinders, pay for DTH services, and even settle electricity or water charges – all within a few taps.

The app also supports QR code-based payments, making it extremely convenient to pay at local shops, supermarkets, petrol pumps, and even street vendors. This feature has helped PhonePe grow as one of the most trusted and widely accepted digital wallets in India.

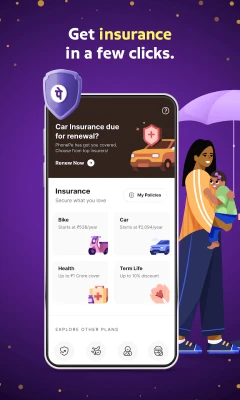

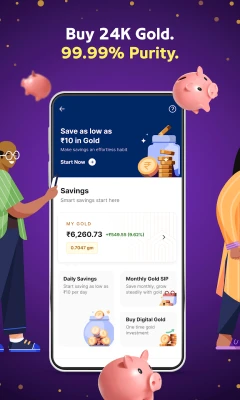

Beyond basic transactions, PhonePe goes further by offering insurance, gold purchase, investments in mutual funds, and digital wallets. This makes it more than just a payment app – it is a complete financial platform in your pocket.

Security is a top priority for PhonePe. Each transaction requires UPI PIN verification, ensuring that your money remains safe. The app also uses advanced encryption and fraud detection systems to protect users from unauthorized access.

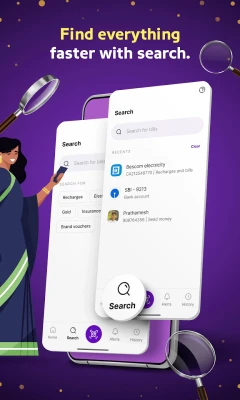

PhonePe’s user-friendly interface, multiple payment options, and rewards system make it one of the most reliable apps in the digital payment ecosystem. Whether you are splitting bills, paying online, or shopping offline, PhonePe ensures a quick, secure, and hassle-free payment experience.

Rate the App

User Reviews

Other Apps in This Category

Popular Apps

Editor's Choice